By Tomie Balogun

Do your dreams scare you?

Mine do.

As a child, I remember looking forward to being an adult. I thought it would give me the freedom I really wanted. Boy, was I wrong? Lol

Growing up, I went through the typical ‘finding my identity’ phase every pimpled-teenager goes through. I’m pretty sure my only dream, back then, was to make money. That’s because I gullibly believed money would give me independence.

Fast track to years later, I don’t just want to make money, I plan to make lots and lots of it. I plan to have wealth for influence, global impact and the independence it brings.

How about you? What do you dream about?

Travelling all around the world? Living in a mansion by the ocean where you fly out on your private plane to meetings?

Hmm…maybe that’s too far-fetched.

Do you dream of just being able to pay your bills conveniently? Having the option to not get stuck in traffic on your daily commute? Being able to conveniently afford the basic necessities of life?

Whatever your dreams are, I really hope they come true.

However, just so you know, it won’t come true if all you do is go to bed with your dreams every night, and not take responsibility.

Creating wealth or streams of additional income is an outcome of two key things: the event and your response.

The event is pretty much defined right now; high cost of tomatoes, low value of Naira, hike in fuel price. Your outcome will be determined by your response to these events.

How can you respond? By taking responsibility for your future and your own fate. Every monetary decision you make today will culminate in your monetary outcome in the future. Every investment decision you make in assets or skills will add up to a reward eventually.

You have the ability to respond in favor of yourself. Yes, you do with these three options.

- Save. Invest. Invest

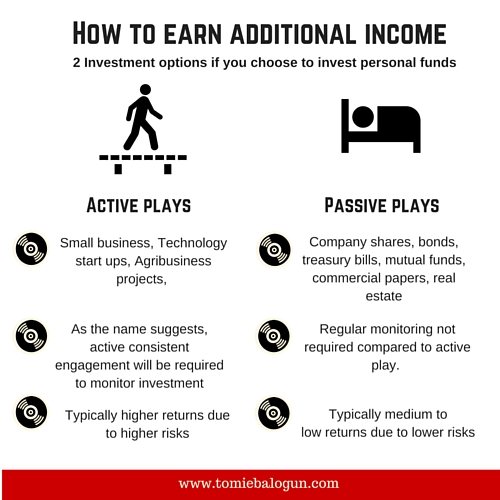

You should reduce spending on unnecessary expenses, save up and invest in active plays or passive plays.

If you’re risk averse I.e. you don’t take risks with your hard earned cash. Then you should consider passive plays. Hmm…but be aware low risk equals low returns. I’m not advocating you take risks oh…just saying don’t expect anything extraordinary if you invest in passive plays. Some good examples of passive plays include investing in mutual funds, commercial papers, company shares etc.

The stock market is not a bad option if you have a very long term investment plan. Talk to experts to know what stocks have the best returns and invest.

If you the risk taker, try active plays but mitigate the risks as much as you can. One of my active plays last year was to put a car on Uber. It’s active and I mitigate risks with a car tracker. Small businesses in need of capital can also be good active plays.

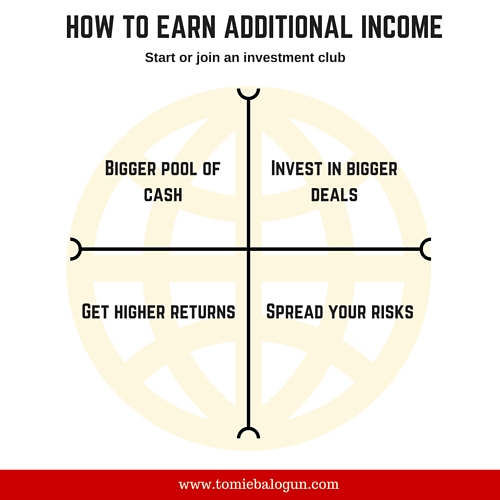

2. Play a bigger game. Start an investment club.

30 months ago, I and 4 of my friends realized our personal funds were not enough for the type of investment opportunities we were interested in. So we joined forces and started an investment club. Our investment club (later formalized into a limited liability company) gave us the opportunity to pool funds and make investment decisions as a team. So far we have invested in two small businesses and plan to a lot more on a consistent basis.

This is not the popular ‘Ajo’ where people save money together and take back money saved after a defined period. This is different. This is putting money together to invest in opportunities one person might not be able to make alone.

- Start a side gig or main gig. Your choice?

And finally, provide value to people to earn income. This is a no-brainer, right? Lol. Most people already have a side business or are thinking about starting one. If that’s the case, you’re on the right path. I’ll just caution, you do it the smart way.

There are 4 types of businesses that make money easily in a challenging economy

(1) A business that provides value people use habitually. Classic examples are food, disposables, toiletries.

(2) A business that has a ready market. (Think import substitution)

(3) A business that provides virtualized services. Think an online business that replaces a physical store. e.g. laundry services, grocery shopping. It doesn’t have to be an e-commerce business.

(4) Provide a service with your skills. Yep, your current skills. Can you teach GMAT? Find those who need it and have them pay for your service. Can you cook? Cook for a fee. Do you love fitness? Put together a fitness plan and sell it.

Find your voice and provide a service in a way only you can because nobody else has your finger print. I hope this helps

Tomie Balogun provides business advice for professionals who work 9-5 but need additional streams of income. She takes a different approach compared to most ‘experts’ out there. She provides actionable advice in a relatable way that makes it easy for a professional, such as yourself, to earn an additional stream of income.on her website www.tomiebalogun.com.

2 Comments

This are informative and useful tips.. thanks.

Thank you for using simple terms; I’m sharing with the world.

Leave a Reply