I am always pleasantly surprised by how much women learn when they come together. Wana Udobang and I put together the #RedefiningFinance Event in April this year. As we planned the event, we weren’t sure what to expect. All we knew was there was a dearth of personal financial planning amongst our peers and we wanted to create a platform that plugged that gap.

Over 100 women turned up and together, with the help of the amazing financial guru and guest speaker Arese Ugwu (Founder of Smart Money Africa) and a panel comprising of the award winning Make Up artist Elaine Shomya, Brand Strategist Aurora Moneyi and CEO of Uzo’s food Labs, Uzo orimalade, we learnt PRACTICAL steps towards securing our financial future.

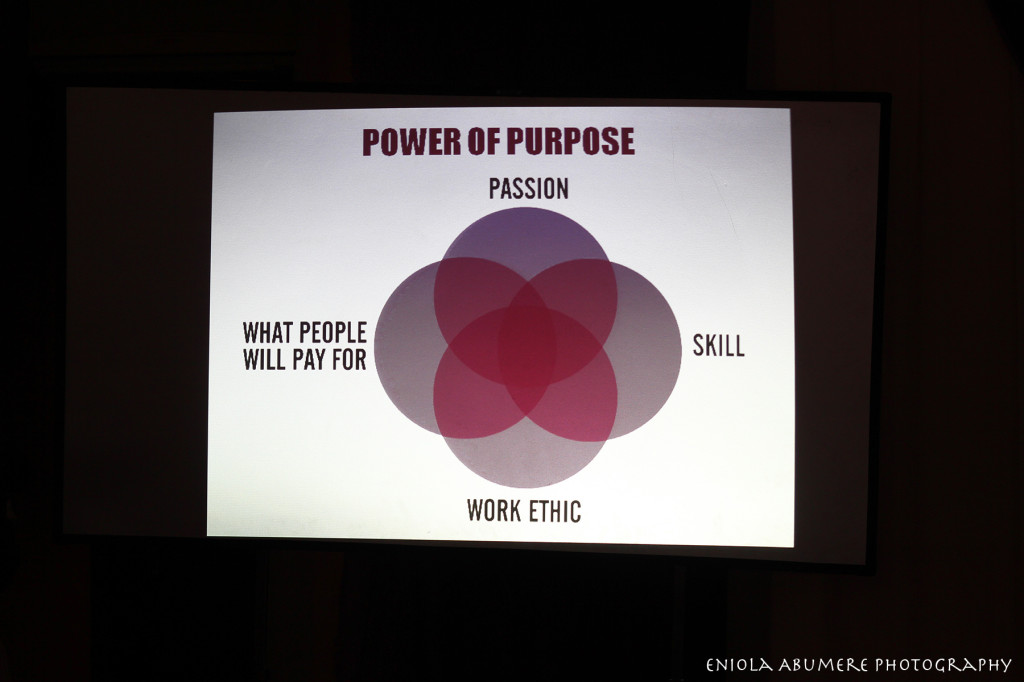

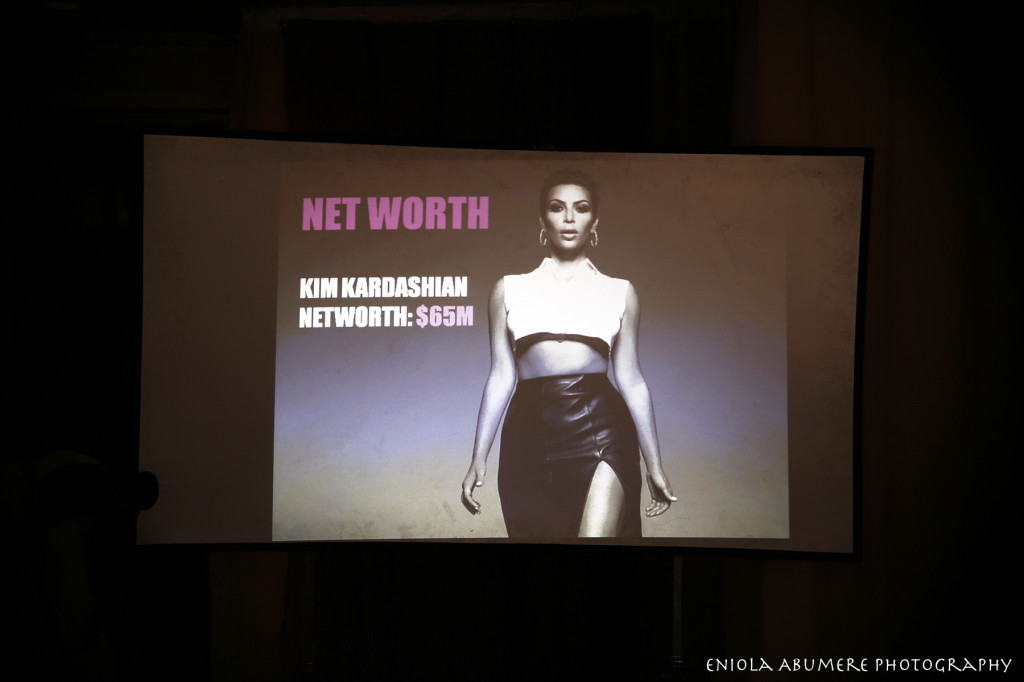

As with all things that involve changing a narrative, Arese took us through some of the negative money mind sets that have kept us from making wise financial decisions.

“Save not just for a rainy day, but for a flood!”- Arese Ugwu

Life as we know it is anything but constant so spending all you have now without much thought for the future leaves women vulnerable.

“Have an Emergency Fund, which is equal to at least 6 to 9 months of your income”- Arese Ugwu

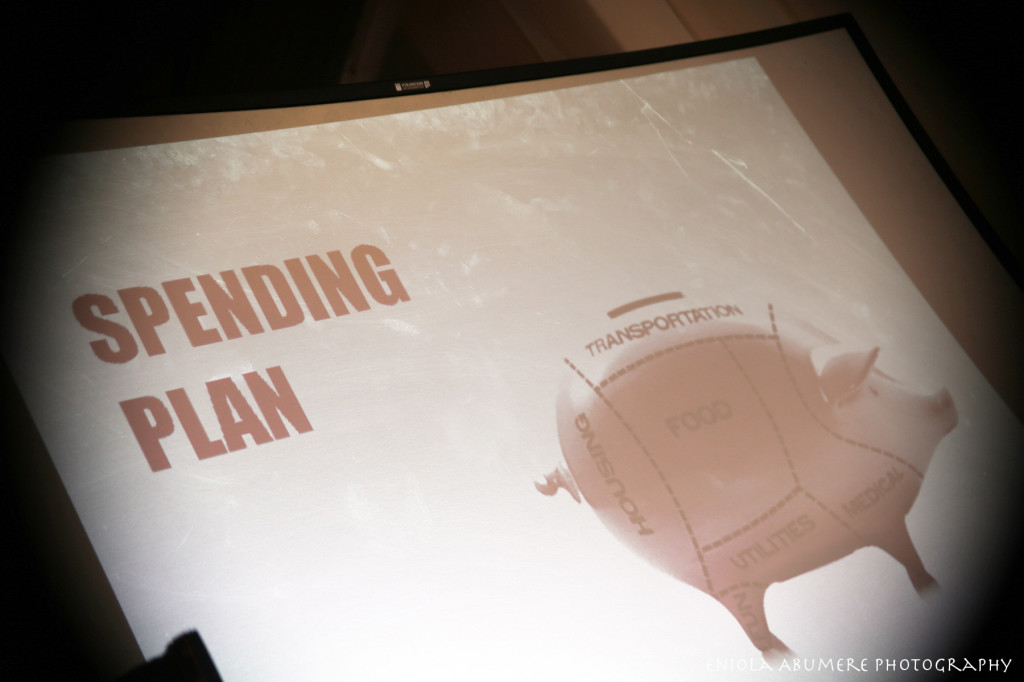

Some of the practical tips given included spending less than you earn and having multiple accounts but with limited access and a 70% (Living Expenses), 20%(Long-term financial goals), 10% (Short-term financial goals) savings and spending plan. For more practical tips on savings watch Arese’s guest vlog here.

The Panel discussion, facilitated by Wana Udobang brought clarity to some of the tips offered by Arese. Each panel member shared their own tried and tested methods for savings, investing, starting a business and taking steps towards securing their financial future

Uzo Orimalade of Uzo’s food labs –

Transitioned from a full time investment banker into an entrepreneur . How?

- Drastically cut down on all unnecessary expenses

- Made her transitional journey while in full time employment

- Saved a year’s equivalent of her salary.

- Quote to keep: ‘Having multiple streams of income is very necessary, you must balance your passion with your business. You should have people-friends around you that have sound principles about money.’

Aurora Moneyi (Brand manager)

Money management tips

- Delayed gratification is key- never get what you don’t need

- Always have a budget- no impulsive spending

- Avoid paying rent above your 3months salary

- Quote to keep: ‘There is nothing like class or status, no one sits and thinks about what shoes you wore to work yesterday’.

You should aim to cut off rent as soon as possible. If you can get a land or business, get it. Start investing in stuff you can trade for more value-cars, shoes, bags … aren’t assets, anything you get and trade for less than what you got it for isn’t an asset.

Elaine Shobanjo (CEO Shomya Cosmetics)

Married with kids and managing your finances…

Married with kids and managing your finances…

- Started saving from the age of 15

- It’s a whole different ballgame when you are married and have kids.

You might have a fixed income and it will be gone for nappies, kids funds, schools, etc. So the easiest time to even develop the habit of saving is now. - Choose your mentors carefully

- Quote to keep: Securing your financial future also means developing your skill. I paid over $2500 for a makeup artistry class. You need to have the skills to excel in what you’re passionate about. If it means investing a large sum of money to improve your skills, do it!

After the event, we had plenty of hugs, kisses and off course selfies to go round 🙂

For more information on the event Watch the video below

Did you attend the event? Can you spot yourself in any of the pictures? Let us know. Make sure you subscribe to the channel to find out about the next event in September!

Special shout out to our media partners: Olori Supergirl, Bellanaija.com, 360Nobs, SisiYemmie, Spreadmedia.com and Wana Udobang

Also major thanks to the entire team:

Event Coordinator- Events by Bani

Social media– Team Poutzy

Photography– Eniola Abumere

Videography– Jay Jituboh

Venue, Food and Drinks- Social Place

Leave a Reply